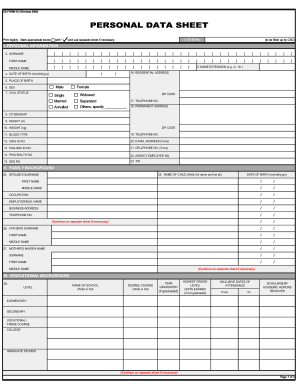

Who needs a nf3 form?

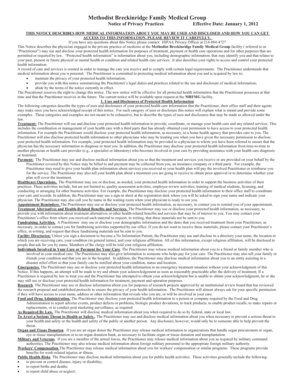

This form is to be filed by physicians or doctors who examine a patient after a vehicle accident and prescribe a treatment for him. His insurance policy can cover the expenses for the visit, medical tests and medicine, which is why the doctor has to send this form to his patient’s insurer.

What is form nf3 for?

This form is used to solve the matter of payments between the health provider and the patient. Sometimes health providers refuse to wait for the payment from the insurance company, so the patient has to pay for the treatment himself. In order to inform the insurer, health providers have to complete this form.

Is it accompanied by other forms?

It doesn’t require any addenda, however the insurance company may request copies of the receipts and test results from the health provider.

When is this form due?

This form should be completed and submitted to the insurer no later than 45 days or 180 days after the treatment started. The due date depends on the kind of insurance policy.

How do I fill out form nf3?

If your insurer has already got a report about the accident, just write down the changes from the information in that report, like additional charges that occurred recently. Otherwise, answer all the questions and fill out all the tables on this form in order to provide the insurer with the fullest report.

Where do I send this form?

Send it to the insurance company that provides your patient’s policy. Ask the patient to give you the contacts, as they must be included in his medical records.